INVESTMENTS

At The Erie Community Foundation, we manage funds for the long term to maximize the power of your gift. For nearly a century, the Foundation has guided countless charitable funds through a careful and strategic pooled investment program.

The Foundation uses the premier investment advisory group in the country for endowments and community foundations: Cambridge Associates, which represents some of the most prestigious organizations and universities in the nation.

An Investment Policy Statement, adopted by the Board of Trustees of The Erie Community Foundation, ensures good philanthropic stewardship and prudent investment of its investment portfolio.

Long-Term Growth

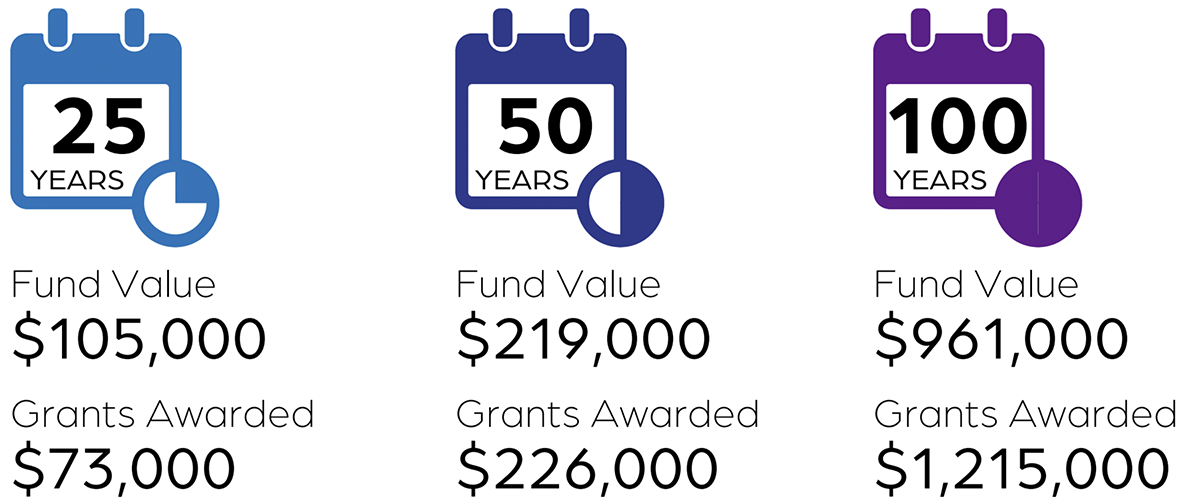

If you were to invest $50,000 today, your impact over the next 100 years would substantially increase:

This assumes an annual growth rate of 8%, which is the target established by our Investment Committee (4% spendable for grants/donations, 1% for administrative/investment manager fees, 3% growth of principal).

Our Portfolio

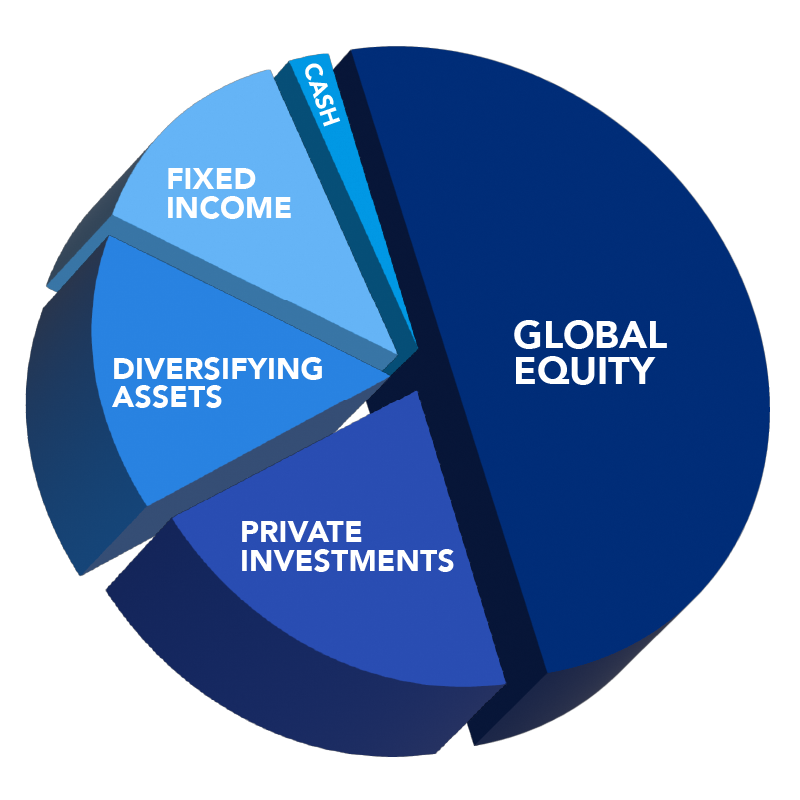

Diversified Portfolio Investments are essential to accomplish investment goals. At The Erie Community Foundation, we seek a real return objective at a tolerable risk level by investing in the following assets:

Global Equities are comprised of equity investments in U.S. and non-U.S. companies, including emerging and frontier markets, diversified by country, economic sector, and market capitalization. The principal purpose of global equities is to provide for long-term growth of the capital pool.

Private Investments include private equity/venture capital and private real estate / natural resources / infrastructure, and other non-marketable securities. These investments are intended to outperform traditional equity investments over the long term.

Diversifying Assets helps reduce the return volatility of the overall portfolio, while generating long-term returns between global equity investments and fixed income investments. These investments, diversified by manager and strategy, are comprised of funds with high levels of transparency, reasonable liquidity, and little portfolio leverage.

Fixed Income investments minimize risk by reducing the overall volatility of returns. Components of fixed income investments may also serve as a partial hedge against periods of prolonged economic contraction. Most of the fixed income portfolio is comprised of high-quality government and corporate securities, which typically outperform other fixed income securities in an economic contraction or short-term economic shock.