PROFESSIONAL ADVISORS

Professional Advisor Program

At The Erie Community Foundation, we work hand in hand with you to leverage opportunities arising from significant financial events.

For more information, contact Steve Weiser, vice president of philanthropic services, at SWeiser@ErieCommunityFoundation.org or 814.413.7345

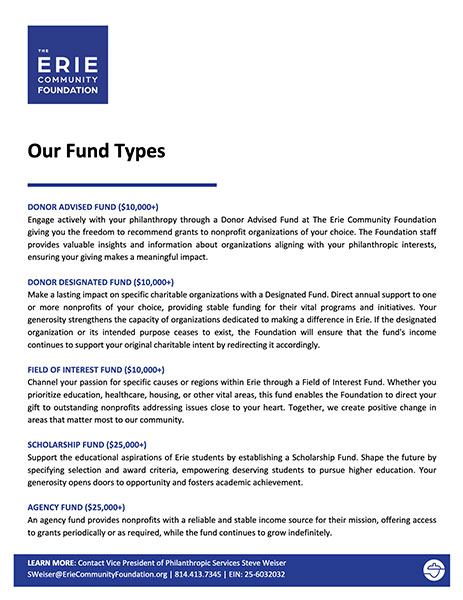

Planned Giving

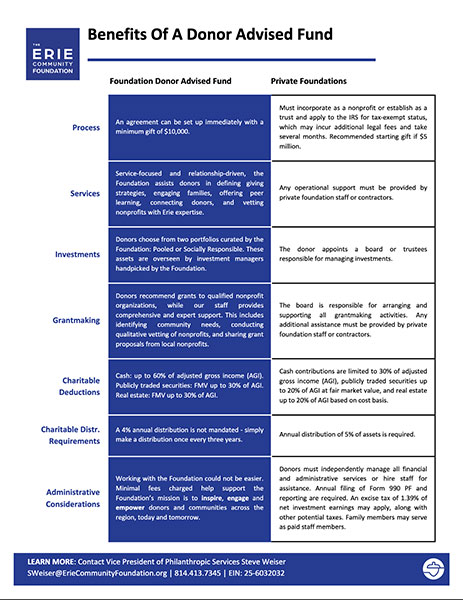

Private Foundation Alternative

Benefits of DAFs

We offer several avenues of investment for our endowment funds, which include local management, a socially responsible pool, and our primary endowment pool. Our donors can also choose to have their new endowment of $250,000 or more managed by their personal investment advisor

Complex Gifts

- Check, wire transfer, or credit card

- Appreciated Securities

- Publicly traded stock and mutual funds.

- Real Estate

- Donate residential or commercial properties, farmland, or timberland to make a lasting impact.

- Business Interest

- Privately held stock, limited partnerships and other business interests.

- Transfers from Charitable Entities

- Transfer assets from a private foundation or donor-advised fund to create a Foundation fund, ensuring seamless management and continued philanthropy.

- IRA Qualified Charitable Distribution

- If you’re 70 1/2 or older, make a QCD of up to $100,000 from your

- IRA into various Foundation funds to support our community. If you’re 73 or older, this can count towards your RMD.

- Bequests, Retirement Plan Assets, and Life Insurance

- Include the Foundation in your estate planning by naming your fund as the beneficiary of your retirement account or life insurance policy.

- You can also transfer a life insurance policy irrevocably to the Foundation, ensuring your legacy of giving endures.

Types Of Gifts

Wealth Events

A Meaningful Legacy

- Inheritance sale of a business

- Sale of real estate or other assets

- Lump-sum retirement payout legal verdict or settlement

- Divorce settlement

- Exercised stock options

- Capital markets transactions/initial public offering

Whether these events are anticipated or unexpected, they present both possibilities and challenges. With our extensive experience and as Erie’s leading charitable organization, the Foundation stands ready to guide your clients through the process. We’re committed to assisting individuals in creating a philanthropic legacy while navigating the financial and legal implications of sudden wealth.

Resources

For more information, contact Steve Weiser, vice president of philanthropic services, at SWeiser@ErieCommunityFoundation.org or 814.413.7345

Professional Advisor Program

Why The Erie Community Foundation

Life Income And Estate Giving

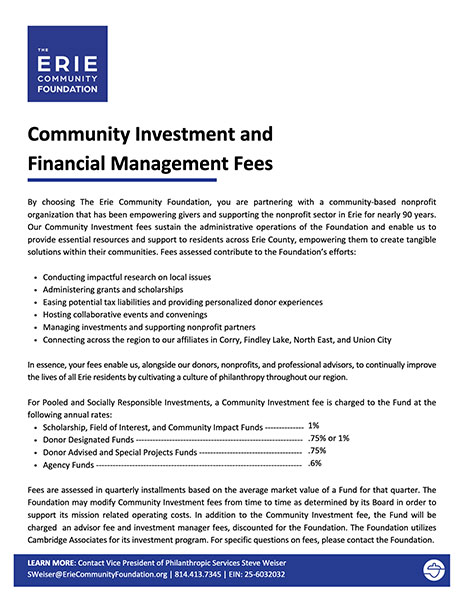

Fees And Admin

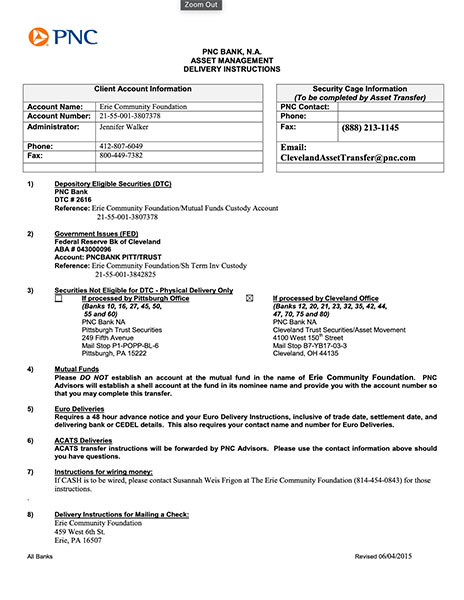

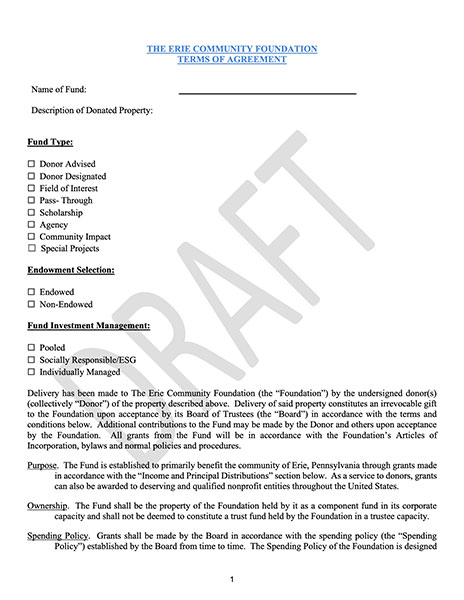

Fund Agreement